10,000

Satisfied

Clients

4.9

Ratings on

Google

Rs.100Crs

Asset Under

Management

Your Expert Financial Advisor

from Bhubaneswar

Bhubaneswar, the capital city of Odisha, is witnessing rapid economic and infrastructural development, making it an emerging hub for professionals, entrepreneurs, and families focused on building strong financial foundations. As Bhubaneswar evolves with IT parks, educational institutions, and industrial growth, the economic aspirations of its residents are becoming more sophisticated and diverse. However, achieving financial security and growth in such a dynamic environment requires structured, expert guidance that goes beyond basic investment advice.

Residents of Bhubaneswar face unique financial challenges and opportunities—from managing career earnings and funding higher education to planning for retirement and protecting wealth. The city’s expanding economy, coupled with evolving tax regulations and market complexities, demands a customized financial planning approach that accounts for local nuances and individual goals.

NS Wealth understands these specific needs and offers comprehensive financial advisory services tailored to the people of Bhubaneswar. As a SEBI-registered investment advisor with a client-first ethos, NS Wealth delivers transparent, goal-oriented financial solutions. The advisory process involves a deep dive into your financial life and the design of strategies for investments, tax planning, insurance, estate planning, and retirement—all curated to align with your long-term vision.

For Bhubaneswar’s emerging achievers and established families, NS Wealth brings a blend of local insight, regulatory expertise, and a commitment to ethical, fiduciary advice that empowers you to make confident financial decisions—Trust NS Wealth to guide your journey toward sustained financial success in the city’s vibrant economic landscape.

Looking to speak to an Expert?

We have experts who can assist you right now by phone or via an online Google Meet meeting.

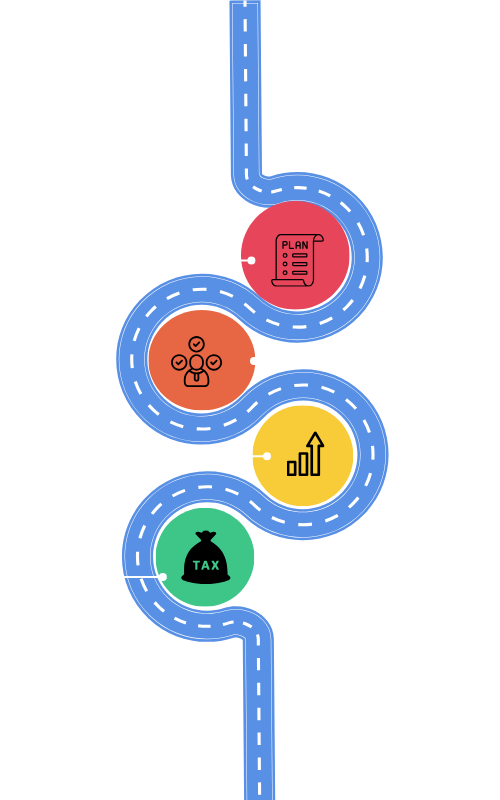

NS Wealth’s Process

At NS Wealth, we follow a proprietary process developed by our team, called the Dream, Decide, and Do framework. The core principles underlying this financial advisory process are transparency, research orientation, and risk management. Our fee-only advisory model aligns the advisor’s incentives with the client’s, forcing the advisor to avoid mistakes. We focus on creating actionable strategies that align with our life goals, income patterns, and risk tolerance.

Our Process includes:

Financial Health analysis: We begin by gaining a clear understanding of your current financial health, including your loans and preparedness for short-term and long-term financial emergencies & shocks. Fixing this before you start working on your financial goals is paramount to success.

Goal-Based Planning: Everyone has financial goals, ranging from buying the dream home to getting your kids educated to saving for retirement. We analyze them based on your current economic conditions, future life scenarios, and current investment strategies.Having a goal-based approach and adhering to it when investing increases the probability of success.

Portfolio strategy design: Based on your goals, risk profile, and financial health, we build a diversified investment portfolio using asset allocation and, if required, restructure your debt.

Portfolio implementation: Based on the strategy design, we identify the appropriate set of financial products that align with the required strategies, are tax-efficient, and are in line with future market conditions.

Periodic Review & Rebalancing: Our team reviews your portfolio regularly and holds quarterly client meetings to align it with market dynamics, changing life goals, and tax regimes.The review process helps our clients to stay on track with their financial goals.

Who we serve

Why should Bhubaneswar choose us?

Given the rising complexity, navigating one’s financial journey in Bhubaneswar requires proper guidance from a financial expert who understands the local landscape and has a deep knowledge of financial markets. NS Wealth brings together a team of trained financial advisors from Bhubaneswar with expertise in financial planning, investments, insurance, and taxes. Our client-centric approach makes us an ideal partner for every Bhubneswarite.